how to become a tax attorney reddit

Domestic Violence 800 799-7233. 1st Floor of Courthouse - 210 5th Ave.

:max_bytes(150000):strip_icc()/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)

Accounting Vs Law What S The Difference

Additional property tax information is provided on the secured and unsecured tax pages.

. Securities products are provided by Merrill Lynch Pierce Fenner Smith Incorporated also referred to as MLPFS or Merrill a registered broker-dealer registered investment adviser Member SIPC layer. The person who is giving his or her power is known as the principal the grantor or the donor. NE Independence IA Phone.

202223 taxes become due. Consult your own attorney for legal advice. 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer.

Tax Audit Notice Services include tax advice only. Westside Family Preservation Services Network 559 945-1022. We wield the power of law and the strength of partnership to protect peoples health.

The first installment is due on November 1 2021 and will become delinquent if not paid by December 10 2021 at 500 PM. Form W-4 tells an employer the amount to withhold from an employees paycheck for federal tax purposes. Attorney Attorney at Law Attorney General Lawyer What they do.

Land qualifies for special appraisal 1-d-1 appraisal if it has been 1 used for agriculture for five of the preceding seven years and is currently devoted principally to agricultural use as defined by statute 2 used to protect federally listed endangered species under a federal permit or 3 used for conservation or restitution projects under certain federal and state. The three major credit reporting agenciesEquifax Experian and TransUnionremoved tax liens from their credit reports as of April 2018. The Tax Collector now has drop boxes available for your convenience.

319 334-7456 Drivers License 319 334-4340 Property Taxes. A Power of Attorney may be required for some Tax Audit Notice Services. The agencies stopped reporting them because of the.

You use a Form W-4 to determine the determine how much federal tax withholding and additional withholding you need from your paycheck. Durham County Government continues to make the safety of all citizens and staff a high priority while helping to slow the spread of Coronavirus COVID-19 in Durham. As you fill out the form whether you take a new job or have a major life change you might wonder am I exempt from federal.

We value freedom of speech as much as we do the right to keep and bear arms. If you miss the first installment due date the entire remaining unpaid taxes special assessments special charges and special taxes if any will become delinquent and subject to interest of 1 per month from February 1 st until paid. Tax Administrator 201 East Main Street 3rd Floor.

The Tax Collectors Office is responsible for collecting taxes on all taxable property located in Gaston County using whatever remedies are available under the statutes as governed by the North Carolina Machinery ActOur office maintains accurate information for citizens as well as business users such as banks attorneys real estate agents etc. Power of Attorney Definition. Treasurers Office is located.

And to combat climate change. We are here because the earth needs a good lawyer. The person taking on the power is known as the agent or the attorney-in-fact.

Earthjustice is the premier nonprofit public interest environmental law organization. May specialize in a single area or may practice broadly in many areas of law. Industry-specific news ideas questions stories and anything.

The second installment is due on February 1 2022 and will become delinquent if not paid by April 10 2022 at 500 PM. To preserve magnificent places and wildlife. Discuss firearms politics 2nd amendment news.

You should review any planned financial transactions that may have tax or legal implications with your personal tax or legal advisor. If you choose to pay the bill in full in December or January you need to pay it to your Local Treasurer. A power of attorney also known as a letter of attorney is a legal document that you sign to authorize another person to act on your behalf.

For discussion about what it means to be a Realtor or Real Estate Agent. Represent clients in criminal and civil litigation and other legal proceedings draw up legal documents or manage or advise clients on legal transactions. To advance clean energy.

Failure to receive a tax bill in no way relieves the property owner of the responsibility of paying the property taxes when they become due and payable. Current Secured Tax Bills for FY 2021-22 are scheduled for mailing in October 2021. Elder Abuse 800 418-1426.

II Durham NC 27701 Phone.

What Math You Have To Take To Become A Lawyer

B Com Llb In Taxation Law What Extra Will You Be Studying

Bankruptcy To Business Owner By The Age Of 30 Texas Art And Soul Create A Paint Party Business Online Business Owner Business Money Problems

Supreme Court Emphasises On Simplification Of Tax Law Scc Blog

How To Become A Tax Lawyer In 7 Steps Career Guide

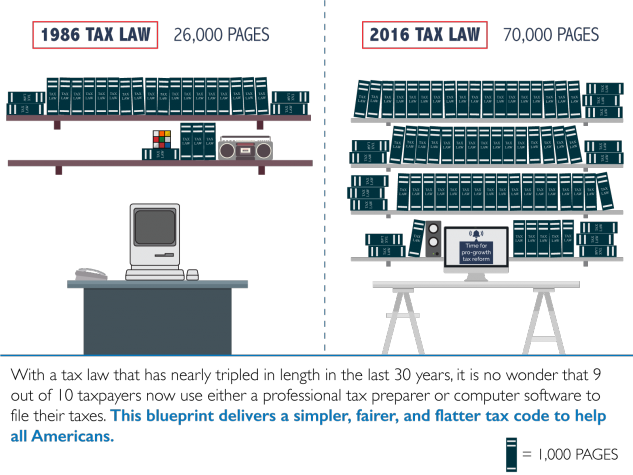

The Myth Of The 70 000 Page Federal Tax Code Vox

How To Become A Tax Lawyer In 7 Steps Career Guide

How To Become A Tax Lawyer In 7 Steps Career Guide

Tax Accountant Career Overview

How To Become A Tax Lawyer In 7 Steps Career Guide

Revisiting General Anti Avoidance Rules In Income Tax Law Scc Blog

How To Become A Tax Lawyer In 7 Steps Career Guide

Are My Business Tax Returns Public Advice For Small Businesses

How To Become A Tax Lawyer In 7 Steps Career Guide

Get Our Example Of Medical Necessity Letter Template Letter Templates Report Template Best Templates

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

How To Become A Tax Lawyer In 7 Steps Career Guide

10 Things To Say Instead Of Stop Crying Coolguides Stop Crying Crying When Someone